Ian Ellingham + Corinivm-Peregrini Media

Building Component Replacement Under Uncertainty

Building Component Replacement Under Uncertainty

January

2014

Ian

Ellingham, MBA, PhD, FRAIC

(Corresponding

author)

Cambridge Architectural Research Limited

Martin

Hughes, BSc, PhD

Cambridge

Architectural Research Limited

William

Fawcett, MA, PhD, RIBA

Cambridge

Architectural Research Limited, Director

Pembroke

College, Cambridge, Fellow

Abstract

The deterioration of building elements requires explicit or implicit financial arrangements to ultimately replace components. In some jurisdictions, various forms of housing are legislatively required to maintain ‘adequate’ reserve funds. However, typical approaches do not account for the variability of building and component life expectancy. This paper uses Monte Carlo simulation to explore and clarify issues associated with the maintenance and management of replacement reserves, and in particular the question of how ‘adequacy’ might be interpreted. It is suggested that, in some projects, underfunding may be preferred to overfunding, but that the final structure should reflect the occupants’ attitudes towards time and uncertainty.

Keywords:

replacements, simulation, uncertainty, management, condominium, facilities

1.0 Introduction

Consultants are often required to assist building owners by preparing budgets to accommodate ongoing replacements of long-lived components. In many jurisdictions such studies, undertaken by a suitable professional, are required for condominium corporations. Other building types, may elect to do so, including leasehold projects, co-operative housing projects, and those involving long-term financial commitments, such as in the case of private-public partnership projects and housing projects with operating agreements with government (Ward, 1999). For some decades replacement issues have been found to be an issue in financial reporting: Bowie (1982) criticized provisions made by property companies for building deterioration and replacements, resulting in an overstatement of profits and an over-distribution of dividends.

The intent of replacement reserves is to distribute the costs of long-lived building components equitably over successive generations of occupiers. Typically, in the case of housing, each unit-holder periodically contributes to a fund to pay for the eventual replacement of the roof, for example. This attempts to create intertemporal equity: each beneficiary pays for a share of the capital elements from which they benefit. Globally, many projects operate on a pay-as-you-go basis, so, for example, the entire cost of roof replacement would be borne by the occupant or whoever else might be responsible when replacement occurred. In extreme cases the lack of a framework for sharing building expenses has led to the roof being replaced by the people on the top floor - the ones needing the buckets - while the occupants of lower floors become free-riders.

When a replacement reserve is established, it is difficult to establish how large it should be. Every property owner should take into account the inevitable attempts of buildings to self-destruct over time. Any predicting of the future is not to be undertaken lightly and planning for replacements to obtain a constant level of contribution does constitute an attempt to predict the future. Buildings vary substantially, as do the settings in which they exist, so the creation of bespoke funding structures matching the replaceable elements of a building does make sense, rather than one-size-fits-all solutions.

The immediate impetus for this exploration came from a non-profit organization that, a few years before, had built a senior-citizens’ housing project. Although not required to maintain replacement funding, they were doing so, and had commissioned a study from a reputable and experienced engineering firm to support the level of contributions. However, they were concerned that the report left questions unanswered, and wanted a second opinion. Answering their questions led to an investigation of the nature of the data and the analysis, and a search for better approaches, in particular through interviews with building investors and managers, and by the use of Monte Carlo simulation.

2.0 Background

Where formal strata title arrangements exist, legislation typically requires that such condominium corporations keep ‘adequate’ reserve funds. For example, the state of Massachusetts requires that “All Condominiums shall be required to maintain an adequate replacement reserve fund, collected as part of the common expenses and deposited in an account or accounts separate and segregated from operating funds.” (Title to Real Property, Chapter 183A Condominiums, Section 10 (i) ). Florida gives more specific guidelines relative to calculation of replacement reserves, but it also gives condominium associations the ability to reduce funding as a result of changes in cost estimates or re-evaluation of the remaining life of building elements. The Ontario Condominium Act 1998 (Part IV, item 29 (b) (v)), requires a funding plan to set out “the recommended amount of contributions to the reserve fund, determined on a cash flow basis, that are required to offset adequately the expected cost in the year of the expected major repair or replacement of each item in the component inventory.” Legal decisions underline this obligation, such as Ebert v. Briar Knoll Condominium Association (N.J. Super. A.D. 2007). In this case the New Jersey Superior Court found that the condominium did not maintain adequate reserves in accordance with a reserve study (Tanzer, 2008).

Beyond legislative requirements, there are matters of practicality. Legislation is designed to require enough money is put aside, presumably in the interests of the unit-holder. The persistent concept of ‘adequacy’ requires some consideration about how an amount might be established.

There is a substantial literature on the aging processes of buildings, extending back at least to the early years of the twentieth century, but largely undertaken through the period of slum-clearance and urban renewal. Systems were proposed to classify the causes of building deterioration, for example by Meij (1961), Cowan (1965), Salway (1986), Lichfield (1988) and Flannigan et al (1989). They underline the complexity of building life histories: Salway (1986, p.51-58), for example, provided an extensive and detailed list of causes of building and land “depreciation”, including such categories as “legal obsolescence” and “social obsolescence”. A division between “physical deterioration” and “obsolescence” has usually been made: one deals with the wearing out of building components, the other relates the ongoing functioning of the building to changes in use, changes in the surroundings, or in the way it is perceived.

2.1 Nature of Building Component Replacement Data

Reliable component life expectancy data is difficult to obtain, and the data underlying many replacement reserve studies might be suspiciously regarded as little better than guesses or folk-lore. One engineer interviewed said that he had prepared some rough guesstimates for one project, only to find they had later been used by another engineer on another project, and presented as reliable data. Suppliers and manufacturers of various building components and systems contacted tended to give single point estimates: apparently, few undertake studies of life expectancy distributions, or have any information on how the point estimate was made.

There are reasons why good information is limited and why it is likely to remain so:

(a) Building components are very long-lived by the standards of most man-made goods. Often a component or system will last longer in service than in production, so by the time data could be observed the products or techniques will have been replaced.

(b) There are many influences on the life expectancy of building elements, including exposure to the elements, the nature of use and abuse, the quality of the initial installation, the maintenance regime, and the failure of other related elements. The conditions affecting components, and hence their service life, can vary substantially.

(c) There is no ready means of compiling detailed data from numerous owners and managers. Beyond the guarantee period, few building owners will report failures to the manufacturers.

(d) Many components will be replaced before they are worn-out, due to changes in fashion, accidental damage, or through preventative maintenance.

Nevertheless, some data sources are available. There are some for building services components, such as the online “ASHRAE: Service Life and Maintenance Cost Database” which deals solely with HVAC (heating, ventilation and air conditioning) systems, the CIBSE Guide M, and the Swedish Building Research Council’s “The Longevity of Building Services Installation”. Two publications that deal with wider aspects of buildings are the RICS/BMI Life Expectancy of Building Components (2001 and 2006), and the HAPM Component Life Manual (1992).

Life Expectancy of Building Components was based on data gathered from experienced practising British chartered surveyors, who estimated minimum, maximum and typical life expectancies for various building elements. That even experienced professionals have difficulties in estimating component lives is clear. For example, in projections relating to ‘asphalt covering to flat roof’ (p.42) the estimates offered by 69 surveyors for the ‘typical’ life expectancy ranged from ‘6-10’ years to ‘96-100’ years, with a mean of 36 years. The ‘minimum’ ranged from ‘0-5’ years to ‘56-60’ years and the ‘maximum’ from ‘11-15’ to ‘100+’ years. Such ranges would suggest that the specific life-expectancies assumed in a replacement budget would depend largely upon the beliefs of the individual preparing it.

2.2 What is the “life” of a component or system?

The when and why about replacing building components are not the simple matters assumed in typical replacement studies. In one obvious sense, replacement occurs because some item or system has failed. The Replacement Reserve Guide (Canada Mortgage and Housing Corporation, 1998, p.3) suggests “A capital item should be replaced when it is no longer performing or operating as it was meant to, no longer cost effective to maintain or no longer safe...” Some building elements, in particular mechanical components, do fail outright, but for many other systems the point of failure is not well defined. Buildings are robust and non-structural failures are rarely life-threatening. Cost effectiveness is relative, and performance requirements are often fuzzy, unstated and may change over time. What were once first-category office buildings can come to serve tenants who are primarily interested in low rent, so are less demanding when it comes to building standards.

Review of replacement reserve studies indicates that while most categories of replacements relate to physical deterioration, others can be driven by fashion: after fifteen years or so many lobbies and corridors will need a ‘make-over’, no matter how well they have survived physically. Some styles and building types are more exposed to fashion than others. Replacements in a building appealing to a high-style urban clientele will probably be managed differently than for lower-income occupants.

Moreover, many failures do not demand immediate replacement, and managers often consider whether to repair or replace. Replacement may occur only when the cost of ongoing repair makes outright replacement look attractive. The 'bottom line' with respect to many replacements was stated by an entrepreneurial owner of a number of buildings, who said that his roofs were replaced "when I have the money", and that otherwise when they leaked, he patched them and cleaned out the roof drains. Another manager discussed a gas-fired roof-top air make-up unit on a large multi-storey residential building. The heat exchanger had cracked, and he had three alternatives - replace the entire aging furnace, replace the heat exchanger, or weld the heat exchanger. The choice was dictated largely by the availability of money. It is clear that many replacements occur when funds are available - so point estimates of life-expectancy are obviously of limited value.

Much replacement in buildings is discretionary - albeit with different degrees of urgency. A leaking roof or a non-functional heating system is more demanding of attention than deteriorating flooring in a service corridor.

3.0 Study Methodology

The issues discussed in this paper were raised through the review of twenty-six reports from European and North American sources, some being posted on publicly-accessible websites. A systematic collection of reports was not undertaken, largely because many organizations regard the information as confidential. In addition, published literature was reviewed, and discussions were held with building managers, engineers, architects and owners. Based on issues identified in this review, mathematical exploration of alternative replacement reserve policies was undertaken.

3.1 Problems Identified in existing replacement studies

The issues identified in the existing replacement studies included:

(a) They are deterministic: components are assumed to fail after a specific service life and are replaced. The uncertain nature of component life, and the ability of management to intervene in the replacement process are not reflected.

(b) They are dominated by masses of minor replacements. This tends to make the reports appear ‘weighty’, yet this may be spurious accuracy: while there are impressive masses of numbers and calculations, the reality is that most of the uncertainty and cost implications relate to relatively few items.

(c) Analysis is limited to a simple adding up of individual projections to get annual total projected expenditures.

(d) The study period is often too short to assess the implications of long-lived building components. Periods of 20 to 40 years are typical, with longer-lived components frequently not entering into consideration. Data from Life Expectancy of Building Components indicates that many experts believe that the typical life of many important building elements is considerably longer. For example, exterior wall systems tend to be excluded from most studies, so money is not collected for their ultimate replacement. When the usual intent (or requirement) is to revisit the replacement question periodically using updated information the exclusion of very long-lived components may be reasonable. However, this implies that current unit-holders may be free riders relative to such components.

4.0 Quantitative Exploration of Replacement Issues

It is appropriate to explore how uncertainty in component life might influence the relevance of budgeting for replacements. There is a temptation to treat buildings ‘scientifically’, following the approaches of other industries, such as the pipeline or oil drilling industry, where component failure can lead to a catastrophic failure of the entire system, often with clear costs, and for which better data exists. Buildings require alternative approaches to modeling replacement processes, and how to budget for them.

4.1 Simulation

A widely-accepted approach to management problems in which multiple sources of uncertainty play a major role is Monte Carlo simulation as was developed by Bon (1988) for building portfolios. The method involves the creation of a model of the system and then randomly drawing from probability distributions for key variables. Large numbers of simulations are run to create a distribution of alternative possible outcomes.

Simulation is a suitable tool for exploring replacements for a number of reasons.

- Construction of the model requires identification of the factors that must be modeled, and how they relate to the overall outcome - the construction effort itself can lead to useful insights into relevant issues.

- The output can be graphical, which is useful in interpreting and communicating results.

- It responds well to sensitivity analysis - that is, changing input variables to see how the results change, which is of particular interest when ‘real’ probability distributions cannot be known, as in the case of building component lives.

- From a practical perspective, it can be undertaken either through basic spreadsheet programs or specialist software.

One limitation in simple Monte Carlo simulation of component lives is that any correlation between the sources of uncertainty will not be recognized. For example, some factor, perhaps exposure, abuse or poor maintenance, may bias multiple components to early failure.

4.2 Creating distributions of component life expectancies

Monte Carlo simulation requires probability distributions for component life expectancy, and a number of possible distributions might be considered. Given that negative life expectancy is impossible, most distributions will have a positive skew - the tail to the right is longer than that to the left.

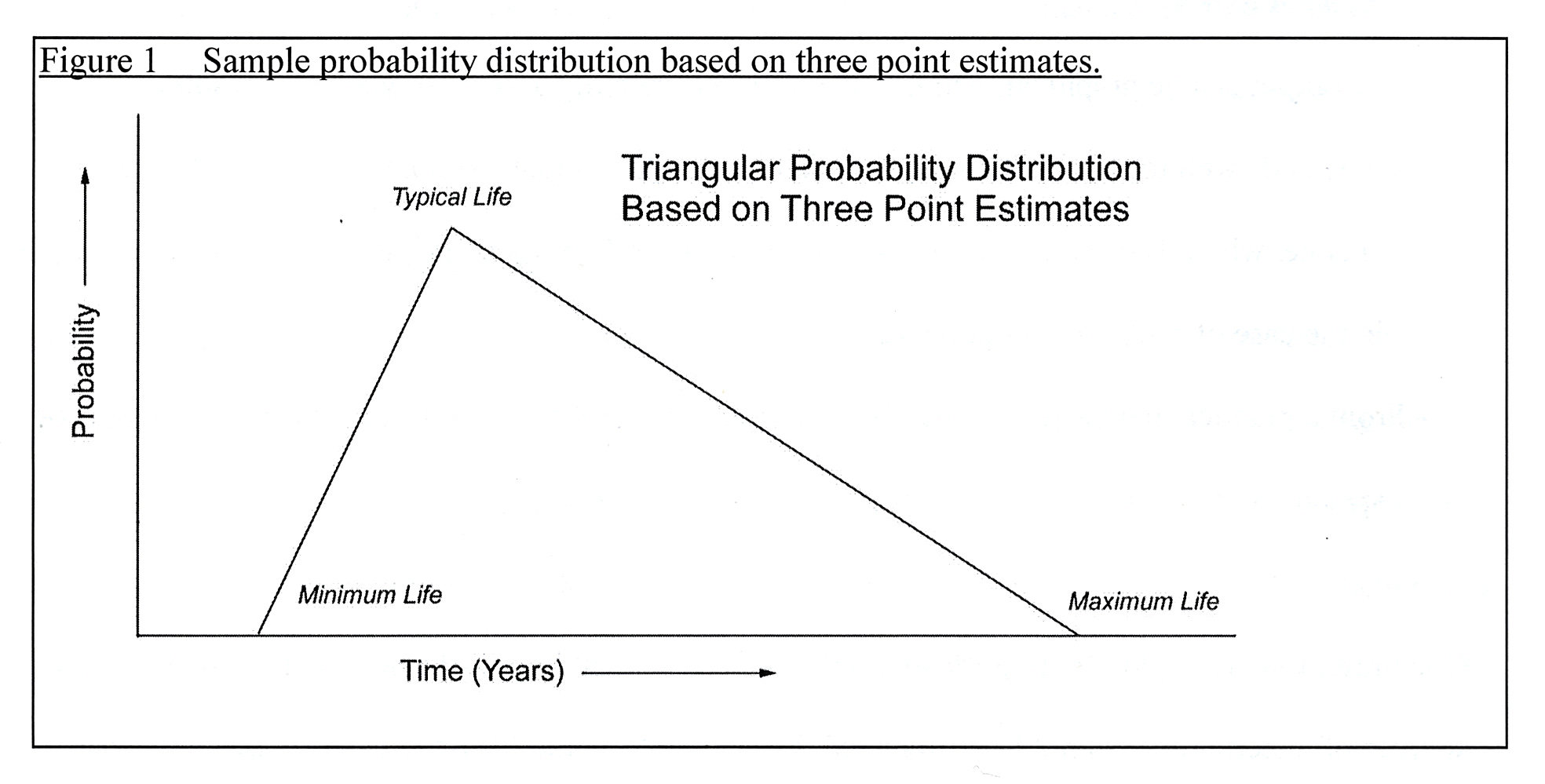

The Life Expectancy of Building Components does suggest an approach to calibrating replacement uncertainty. The three questions posed: “What is the typical life expectancy of the component”, “What is the minimum life expectancy of the component”, and “What is the maximum life expectancy of the component” three points are indicated from which a simple triangular distribution can be created. This data supports the existence of a skewed distribution of life expectancies for most components- with initially few failures, then an increase in the failure rate to a peak, and ultimately a long tail, indicating that sometimes an individual component or system lasts a very long time.

In Life Expectancy of Building Components there are substantial ranges for the minimum and maximum life expectancies. For instance, the maximum life expectancy of softwood windows is suggested as anywhere between 11-15 years and over 100 years, with a mean of 54 years (median 40 years and mode of 36 to 40 years). It is possible to use the means of these distributions to generate a triangular distribution, unless the analyst believes otherwise - although it is also tempting to use the extreme values for the high and low values in one iteration (for the windows a range of 6 to 100 years, with a typical life of 35 years). The shortest estimates may be the result of individual knowledge of premature failure due to poor installation, maintenance, unusual exposure or vandalism. The longest estimates may also reflect the ability of well-maintained 19th century components to survive long periods of time, something not necessarily the case for newer products. Hence, some scenario analysis might be appropriate - such as considering the performance of the components under the best and worst conditions - perhaps based on alternative maintenance assumptions. Any comprehensive analysis should attempt to approximate some distribution for the survival of each component, but as long as data sources are poor fine tuning distributions is likely to be unrewarding.

4.3 Developing A Simulation

A Monte Carlo exploration of replacements was undertaken for a hypothetical twenty-five unit urban housing project - similar to the building from which the original inquiry came. The original engineering study identified 56 replacement items. Of these, ten major items were selected for analysis as being relatively high cost replacements that might be regarded as significant - comprising 63 percent of the total identified replacement costs. Focusing on major cost items is similar to what an entrepreneur might do when purchasing any investment property - directing effort to understanding the exposure to major replacement items rather than spending much time with minor, routine replacements.

Estimates of mean, minimum and maximum life expectancies were prepared based on data in the originating study, other available materials, and consultation with experts. A set of triangular distributions, one for each building component was used to drive the various simulations. One item, the in-unit heating and cooling equipment, consisted of twenty-five separate units, so has its own replacement distribution, which was integrated into the overall model. The life expectancy data used to generate the distributions is shown as Figure 2.

______________________________________________________________________________

Figure

2: Chart of costs and life of building

components

Building Component Replacement Min.Expected Typical Max.Expected

Cost Life Life Life

Roofing

system 170,100 10 25 50

Elevator

(lift) equipment 171,360

20 35 50

Exterior

wall caulking 28,600

5 17 30

Elevator

(lift) cab 105,600

8 28 30

In-unit

mechanical units 143,750

(total) 8 20 35

Parking

surfacing 135,000

12 25 50

Parking

sealing 28,013

4 8 12

Entry

security system 50,625

8 16 22

Exterior

Caulking 25,000

8 12 18

Storm Water

Roof Drainage 22,000 45 55 80

Total 880,048

_______________________________________________________________________________

The situation at the end of each year for a period of sixty years was modeled. After sixty years it is likely that changing circumstances will affect how the building is perceived, functions, and/or is dealt with by its owners and the marketplace. Also, it can be expected that through the analysis period, further consideration of the aging process will occur, updating the model with actual experience of replacement requirements for the building in question, although this has not been included in the model - it might be regarded as a corrective mechanism for the extreme cases.

At initial installation and at each replacement, the years of life for each component were drawn from the applicable probability distribution using a random number generator. Each year, a counter reduced the remaining years of life by one, until it reached zero when replacement occurred and the process started over. A total of 1,000 runs were made for each contribution level. Each run shows a different possible path into the future. Given the estimated life expectancy distributions more runs would not give superior managerial information.

Replacement reserve calculations were set up, showing expenditures on replacements when required, modest investment returns, and tested various contribution levels. No managerial discretion was assumed. A variety of calculations were performed on the output. “Real” prices were used - that is, there was no inclusion of inflation. This implies that any returns from invested reserve funds are at a “real” rate - effectively the “nominal” rate less inflation, and for this, a low rate of one percent was used.

The model generated reports on the status of the replacement costs and the status of the reserve fund.

5.0 Observations

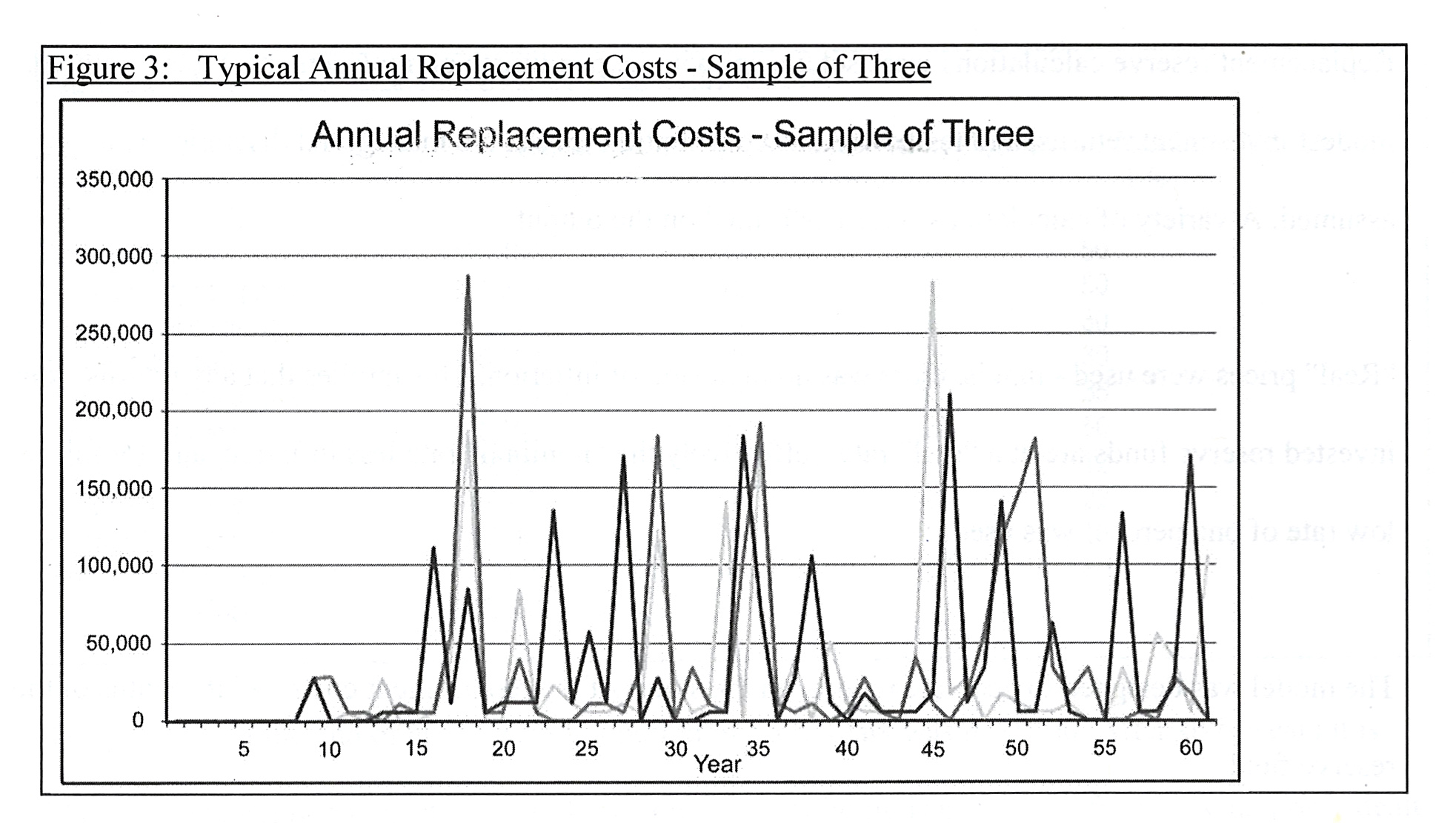

Treating the replacement process probabilistically reveals that replacement costs over the sixty year study period are far from certain. The mean total replacement costs over the study period were approximately $1,710,000, with a standard deviation of $158,000, and outcomes ranging from $1,255,000 to $2,224,000 over 1,000 runs. Figure 3 shows three sample replacement cost series by year.

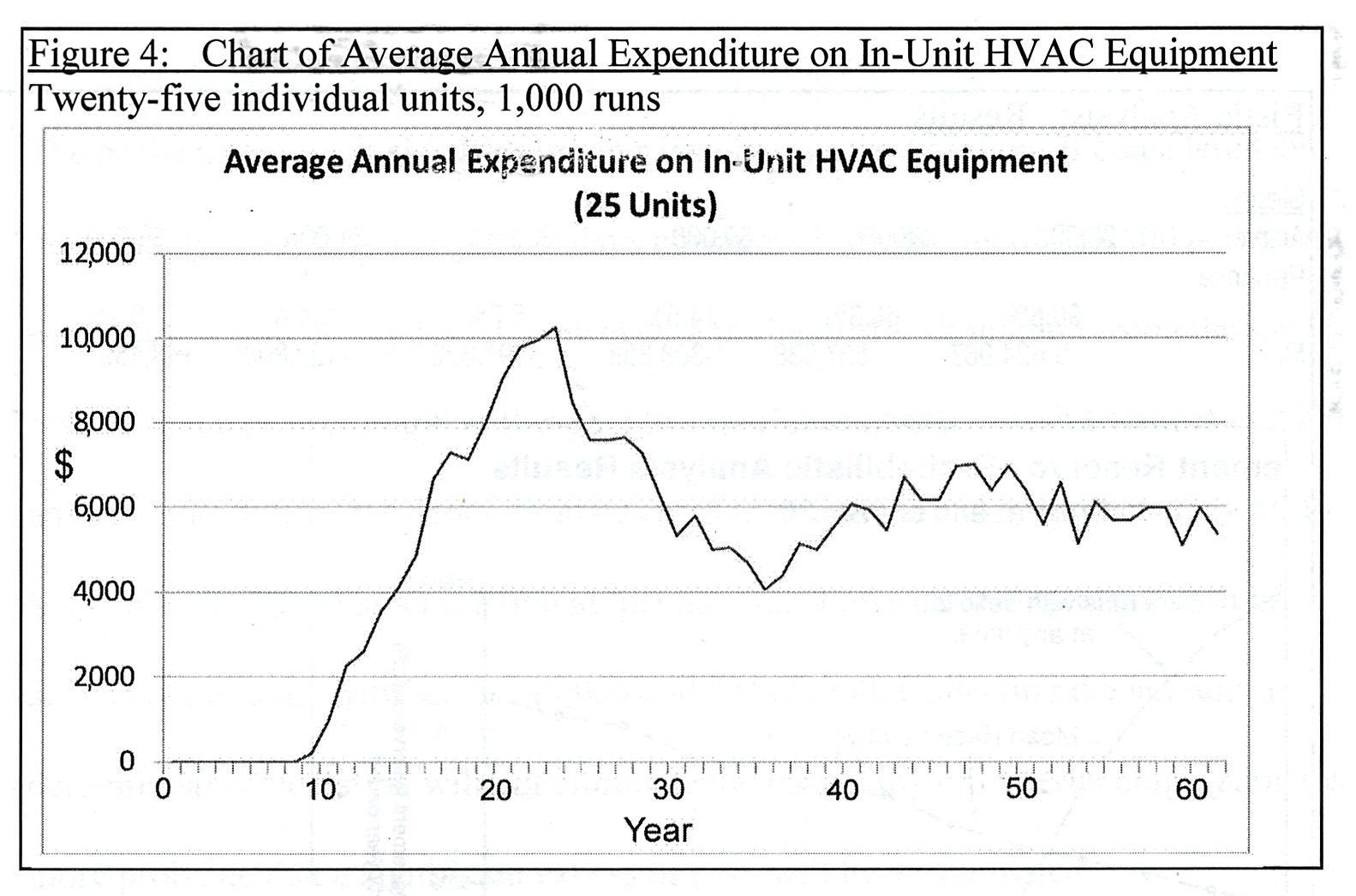

To explore the effect of a proliferation of minor items, the replacement process for the in-unit mechanical equipment was simulated, with one process for each of the twenty five units, and the process integrated into the main model. Figure 4 shows how the mean annual expenditure for the replacement of these units rises over the first twenty years as the units age; then peaks and declines because quite a number of the units have already been replaced, then the cycle is repeated, but damped as a more-or-less continuous, and essentially predictable, flow of replacements starts to occur. This is not what is assumed in most replacement studies - that the units all remain operating until one date, when they all fail and are replaced.

Figure 5 shows a conventional deterministic analysis, suggesting an annual contribution of $32,500 per year toward replacing the ten key components.

__________________________________________________________________________________________

Figure 5: Deterministic Analysis

Analysis over a

period of sixty years.

Total initial cost of replaceable components modelled: 833,048

Annual

contribution to reserve $26,000 28,000 30,000 32,000 34,000 36,000

Percent of total

cost of replaceables 3.1% 3.4% 3.6% 3.8% 4.1% 4.3%

Monthly

contribution per unit $

86.67 93.33 100.00 106.67 113.33 120.00

Number of years

with -ve amounts 27 22 14 8 0 0

Projected minimum

balance $(454,743) (329,121)

(203,499) (79,127) 34,000

36,000

Cash Balances:

Year 10: ending balance $ 272,445 295,597 318,712 341,846 364,980 388,113

Year 30: ending balance $ 79,905 145,527 211,148 276,770 342,392 408,014

Year 60: ending balance $ (454,743) (329,121)

(203,499) (77,877) 47,745

173,366

_____________________________________________________________________________________________

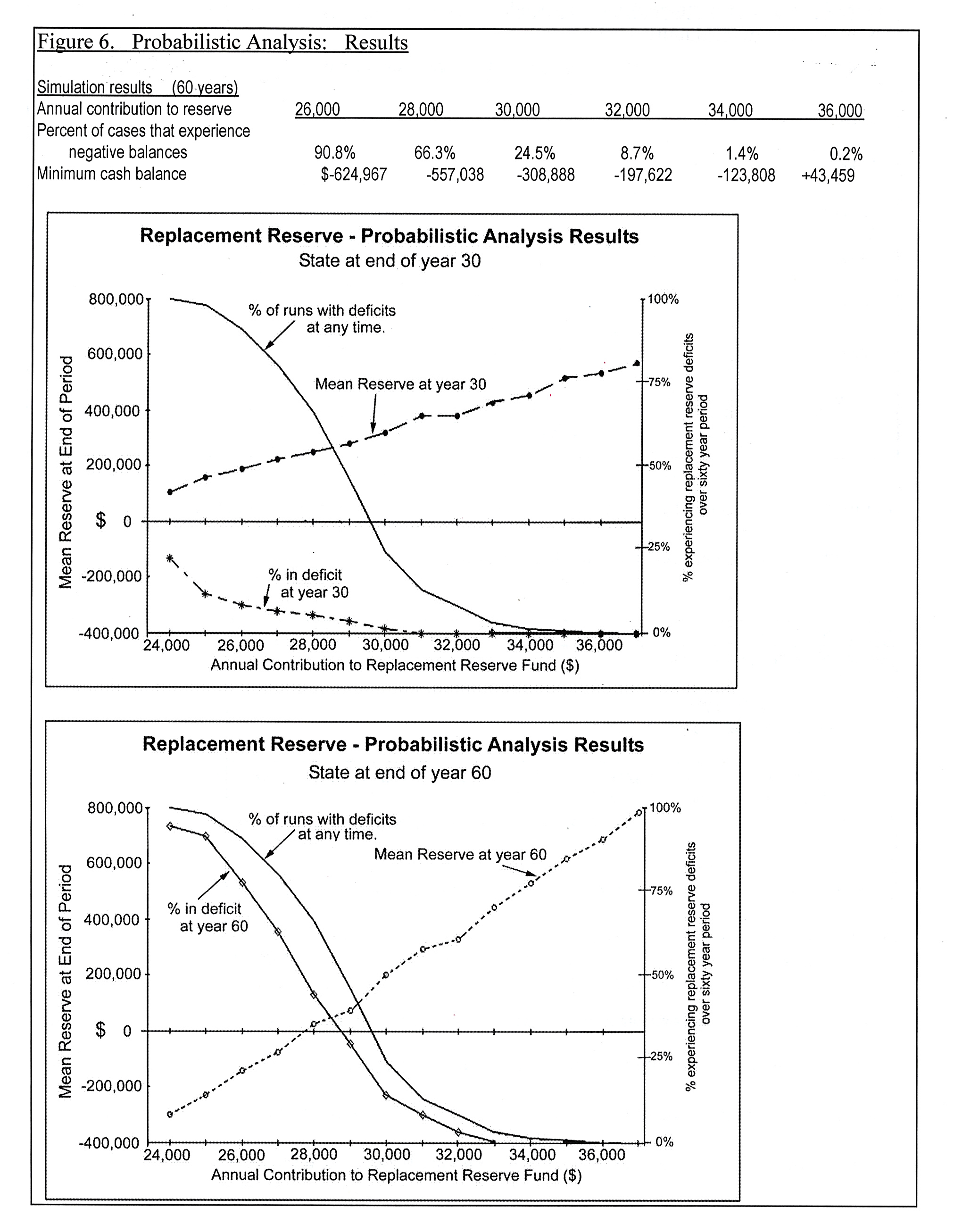

Testing was undertaken using the fundamental question being asked in reserve studies “how much should be contributed annually to the replacement reserve?”. Figure 6 summarizes the results of a probabilistic analysis, for annual contributions varying between $26,000 and $36,000.

The probabilistic analysis offers

greater insight into the situation. If considered deterministically for this

small project, for the eight elements considered, an amount of $33,400 per

year, or $111.33 per unit per month would be suggested. However, a

probabilistic simulation using the same contribution level, reveals that a

project might still expect to experience negative cash balances at some point.

A $33,400 annual contribution does not eliminate cases in which ‘unlucky’

projects may have shortfalls of up to $250,000. A sixty year simulation at that

amount shows an ending mean cash balance of $460,000, it also shows a range

between $-240,000 and $+860,000. Collecting the amount indicated by a

deterministic calculation will not eliminate the possibility of experiencing a

shortfall, even though it is more probable that a significant excess of cash

will be accumulated.

The probabilistic analysis offers

greater insight into the situation. If considered deterministically for this

small project, for the eight elements considered, an amount of $33,400 per

year, or $111.33 per unit per month would be suggested. However, a

probabilistic simulation using the same contribution level, reveals that a

project might still expect to experience negative cash balances at some point.

A $33,400 annual contribution does not eliminate cases in which ‘unlucky’

projects may have shortfalls of up to $250,000. A sixty year simulation at that

amount shows an ending mean cash balance of $460,000, it also shows a range

between $-240,000 and $+860,000. Collecting the amount indicated by a

deterministic calculation will not eliminate the possibility of experiencing a

shortfall, even though it is more probable that a significant excess of cash

will be accumulated.

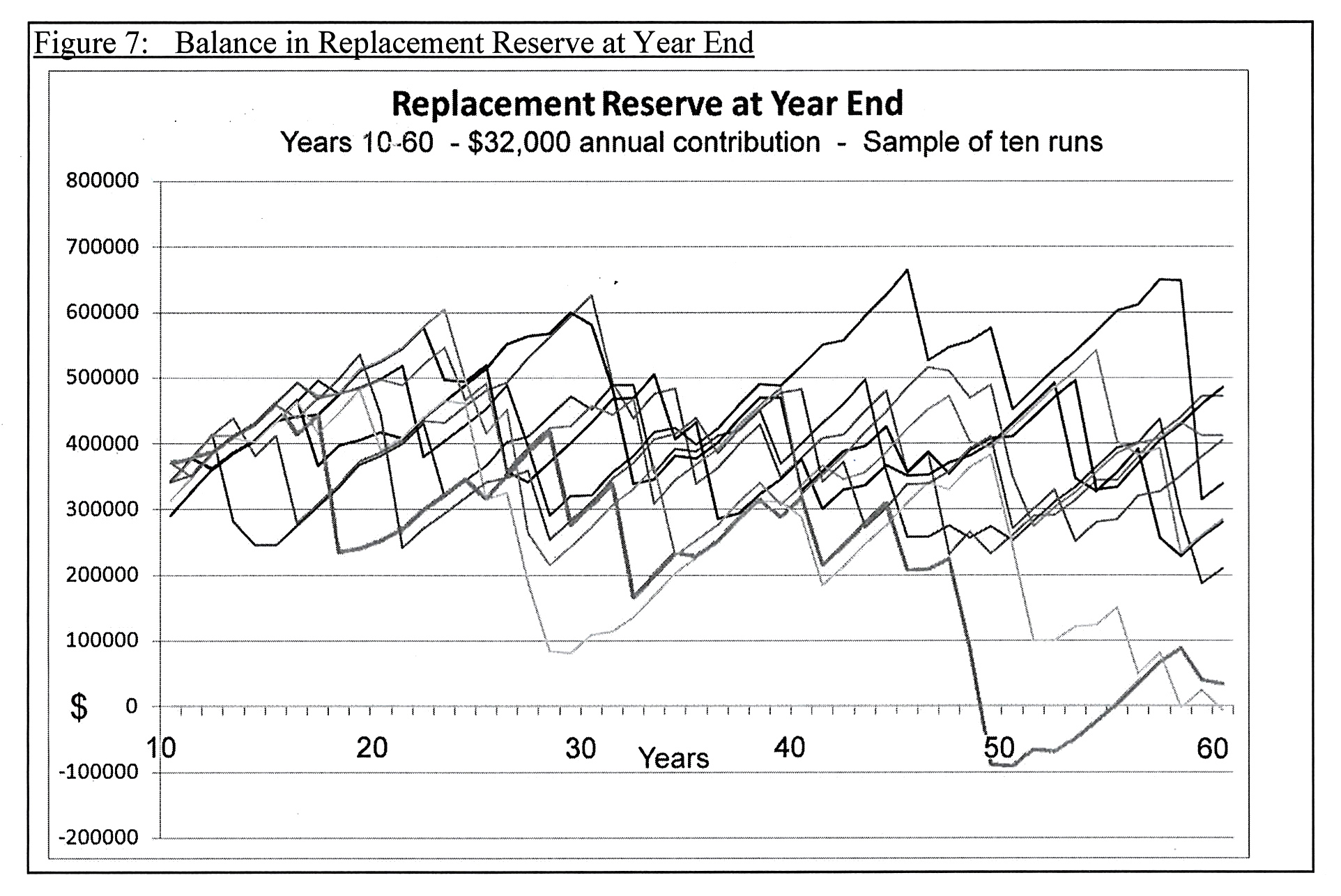

The likelihood of experiencing negative cash balances in the reserve fund can be quantified. When collecting $30,000 per year, 12.7% of simulations experienced negative cash balances, and if collecting $29,000, 25.1% experienced negative cash balances. A variety of paths for individual scenarios can be examined. A set of ten is shown in Figure 7, showing a range of possible outcomes, if $32,000 per year was collected, ranging from substantial surpluses through to periods of negative reserve.

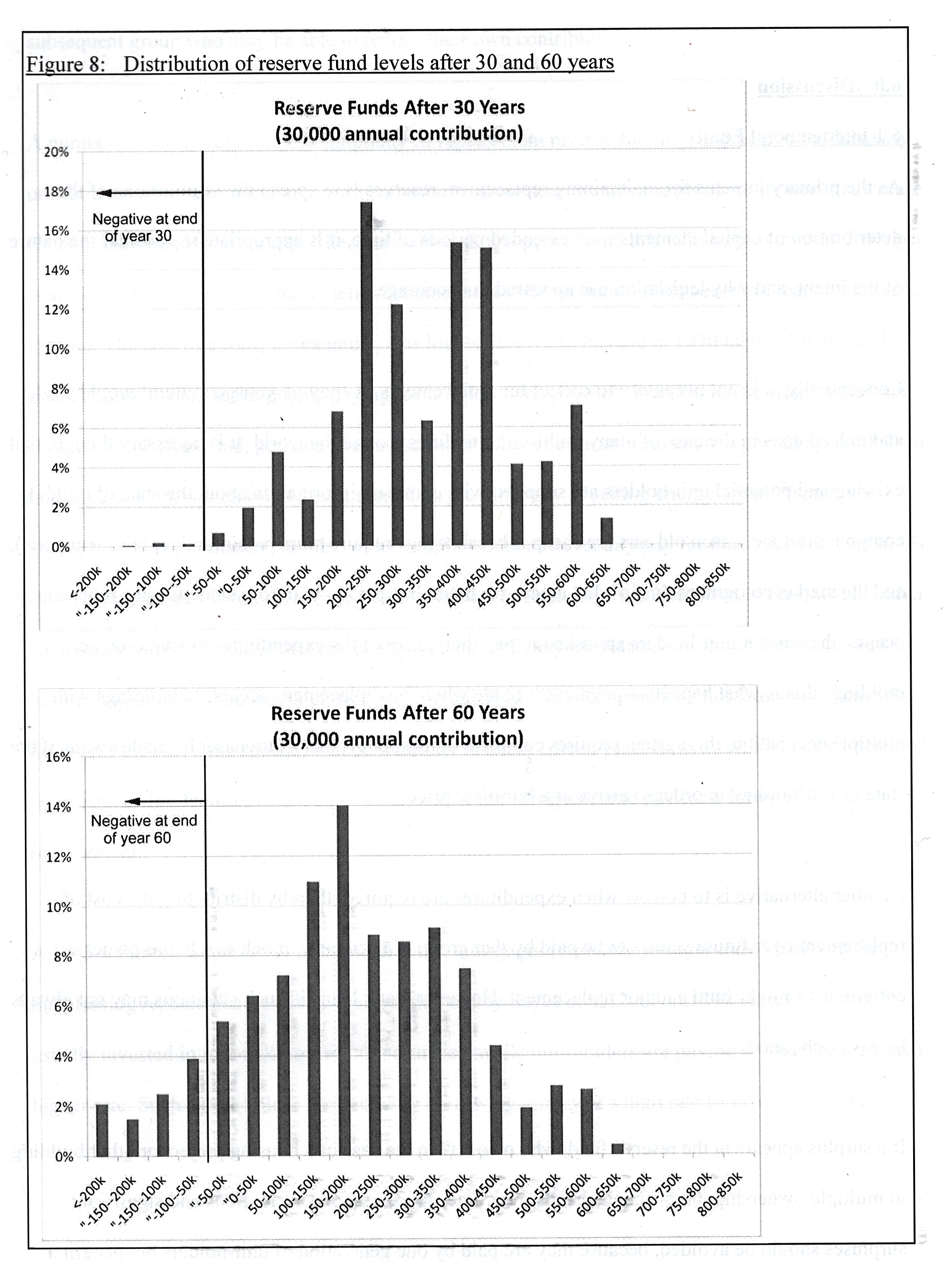

With an annual contribution of $30,000, the distribution of balances in the reserve fund are as indicated in Figure 8, which shows reserve funds after 30 and 60 years. The presence of negative balances at the left tail of the distribution can be noted. The two peaks of the 30 year distribution reflect the impact of the replacement of the roofing and parking surfacing - whether replacement has occurred or not before thirty years has elapsed.

6.0 Discussion

6.1 Intertemporal Equity

As the primary impetus for maintaining replacement reserves is to spread the implications of the deterioration of capital elements over extended periods of time, it is appropriate to consider the nature of the intent, and why legislation has appeared to encourage it.

Conceptually, it is not necessary to plan for replacements. A ‘pay-as-you-go system’ would work, and indeed does in the case of many multi-unit buildings around the world. It is necessary though, that existing and potential unit-holders are supplied with complete information about the state of building components. One reason old cars are cheap is because they require more repair (and replacement parts), and the market recognizes this in what it pays for them. In a pay-as-you-go system, when a replacement occurs, the current unit-holders are asked to pay their share of the expenditure. In single-owner buildings this is what happens - payment is made when the replacement occurs, but a building facing substantial replacement costs is worth less in the marketplace. In buildings with multiple occupation, this system requires complete transparency: that a purchaser be made aware of the state of the building in order to arrive at a fair offer price.

Another alternative is to borrow when expenditures are required, thereby distributing the cost of replacement over future years - to be paid by that group of occupants, much as a home-owner or entrepreneur might fund a major replacement. However, bank loans in such situations may not always be easily obtained.

If a surplus appears in the reserve fund, who owns it? In the case of a housing project or other building in multiple ownership, units change hands over time, so excessive contributions and significant surpluses should be avoided, because they are paid by one generation of unit-holders but benefit a subsequent group who may be able to reduce their own contributions.

A number of matters obscure the simplicity of replacement reserve funding, and help to explain why unit-holders do not universally embrace them with enthusiasm. Over time, wealth and productivity tend to increase for both individuals and society. The UK Treasury Green Book (2003, p.97) found this to be approximately 2.0% per year. As people and societies become more affluent, most goods become cheaper relative to income. The cost of a roof, for example, was higher relative to income in 1960 than in 2010, so of greater consequence to the people paying for it. Moreover, people’s incomes tend to rise as they age - a luxury to a 22-year-old, perhaps a restaurant meal, might be a routine event to a person aged 40. Two housing developers interviewed commented on the difficulty of selling energy-saving features to young first-time purchasers, but that older people would quite readily pay for them. A purchaser in his 20s will assume that in ten years time he/she will be wealthier, so given limited resources, would rather have better kitchen cabinets that can be enjoyed immediately. Replacements are in the future, and he/she, logically, will assume a grater ability to pay then. An older person is not likely to assume that he/she (or the surviving spouse) will be wealthier in ten or fifteen years time, so will be more interested in energy-saving features or a greater assurance of not being asked to pay for a future major replacement.

A further factor biasing many unit-holders with mortgages (typically younger individuals) against maintaining replacement reserves, was pointed out by Sayce et al (2006, p.129): reserve funds are usually invested in low-risk/ low return securities, while unit-holders are paying mortgages at a much higher rate. Such a unit-holder is effectively borrowing money at a high rate to save at a low rate.

It is understandable that many individuals show reluctance to put money aside for replacements, but an individual home-owner is likely to be more aware of the condition of his house, and the work that will eventually be required. The owner of a unit in a collective housing project may require some protection from unforeseen financial demands.

6.2 Spurious Accuracy

One observation from the replacement reserve studies reviewed, is that some are very thick documents. It is implied that more data will make the results more credible. While minutiae can be interesting, understanding the processes associated with the major cost items is more important. Small replacements can be paid for from operating budgets. Too much data can obscure the fundamental issues involved in the replacement of major components. That this happens should not be surprising: managers tend to like quantities of data - often to impress those to whom they must justify their decisions - unit-holders, boards, and government bodies.

6.3 What Determines Adequacy?

The simulation study clarifies the notion of adequacy. It demonstrates that it is inappropriate to collect money at a level that will guarantee that a reserve fund will never run out of money, because in most cases it will lead to a very large surplus being built up. ‘Adequacy’ is more appropriately the level of confidence that a significant special assessment or borrowing will not be required in the future to fund replacements. A reasonable approach is to accept the possibility of experiencing shortfalls, and acknowledge that an occasional unlucky project will experience problems that require extraordinary action. Moreover, the effect of the minor shortfalls indicated in the simulations can be often reduced by the deferment of capital expenditures - repairing the roof one more time, or accepting that the corridor carpets might not be replaced until next year. Simulation also indicates that shortfalls are more likely as the building ages - those cases in which shorter-than-average lives of the components compound. Fortunately, over those longer time frames, adjustments in funding the reserve might be made to recognize the unfolding reality.

Generally legislative requirements use the word ‘adequacy’, not that a fund will never face a shortfall. Experiencing a shortfall does not necessarily imply a failure to plan adequately. The ultimate determination of ‘adequacy’ should be made by well-informed unit-holders, not necessarily an easy process. It will ideally be an expression of their collective risk aversion and time preference. What level of risk will they be willing to accept, knowing that to reduce the possibility of any future shortage of funds will probably result in the collection of an excessive amount of money over the years? This is not very different from what any decision-maker does when making an investment - weighing off present consumption against future benefits, and taking into account the risk that the future benefit may not materialize, or may be of no value to them.

6.4 Underfunding or Overfunding?

Accumulating excessive amount of money over time is especially inappropriate if one considers that (a) future generations will tend to be wealthier (except perhaps in seniors’ buildings), (b) they will have access to technologies and methods that do not now exist, so replacements may be less expensive, (c) there is a managerial ability to defer some replacements for considerable lengths of time by repairing, rather than replacing, and (d) borrowing is possible. Hence, underfunding may be more desirable than overfunding. It would be difficult to refund excess contributions to those who may have overpaid early in the project life, whereas in future years it is possible to (a) ask for more money, which if the earlier occupants are in-situ means they have had the benefit of the difference in rates between borrowing and saving, or (b) borrow, thereby distributing costs over future years, and/or (c) recognising that future unit purchasers may pay a lower price, because the project replacement reserve is underfunded, or because deferment of maintenance makes it less attractive.

6.5 An Investment Question

Ultimately, replacement reserve funding is an investment question. Does one defer consumption now, and invest the money in order to receive some benefit in the future? It is very much like planning for retirement: individuals with different time preferences and levels of risk aversion will choose different strategies. Some will put away considerable amounts, while others may save nothing. The difference is that replacement reserve funding collectively affects everyone in the project, and a single individual cannot select his/her own savings level. Hence, the need for a collective policy, based on the fully informed opinion of the people concerned.

7.0 Conclusions

Attempts to predict the future with precision are impossible, and deterministic forecasts are an unsuitable way of establishing the ‘adequacy’ of replacement reserves. Projections should always recognize and accommodate accompanying sources of uncertainty. Although probabilistic data about replacements is based on poor data sources, such an approach is better than assuming that components will fail at defined future dates. Simulation with sensitivity testing with respect to the underlying probability distributions, is a reasonable way of exploring building replacements and their funding.

As replacement processes are uncertain, maintenance regimes vary and some projects may simply be unlucky, there will always be a need for periodic review of the building condition, the amounts in the reserve funds, and the appropriate contribution levels.

Underfunding may be more desirable than overfunding - contrary to the usual concept of ‘adequacy’. Legislation to discourage underfunding is apparently intended to protect unit-holders from their own short-sightedness. Yet in many projects, unit-holders may be making the “right” decision in underfunding replacement reserves, if that accords with their own time preferences and risk tolerance.

If a lean replacement reserve policy is decided upon, comprehensive disclosure to both current and would-be unit-holders is in order, so individuals can make informed decisions, with potential purchasers perhaps bidding less for units in projects which are likely to require additional future cash infusions - or perhaps bidding more to reflect their preference for lower costs in the short term. As different strategies may be suitable in different buildings, there is a need for managers and consultants to understand the specific expectations of residents as well as the nature of the building. There is a need to incorporate and communicate questions of uncertainty into reserve calculations so as to be able to better inform decision-makers.

Ultimately, it is the concerned and financially-contributing individuals who need to decide upon replacement reserve funding levels that accord with their own levels of time preference and risk aversion, and they need the best possible information. Information assessing and explaining levels of uncertainty needs to be included if groups of people are expected to make informed decisions.

BIBLIOGRAPHY

Abouchar, A., 1983. The Depreciation of Depreciation in Economic Theory, Department of Economics and Institute for Policy Analysis, University of Toronto Working Paper 8314 , Toronto.

Auerbach, A., 1982. The New Economics of Accelerated Depreciation, Harvard Institute of Economic Research, Discussion Paper Series 883, Cambridge, Mass.

Baum, Andrew E., 1991. Property Investment, Depreciation and Obsolescence , Routledge, London.

Baum Andrew E., 1988. Depreciation and Property Investment Appraisal, in MacLeary A.R., and Nanthakumaran, N. (eds) Property Investment Theory, E.&F.N. Spon, London.

Bon, Ranko, 1988. Replacement simulation model: a framework for building portfolio decisions. Construction Management and Economics , Vol.6, pp.149-159.

Bourke, Kathryn, and Davies, Hywel, 1997. Factors Affecting Service Life Predications of Buildings, A Discussion Paper , Building Research Establishment Laboratory Report, Construction Research Communications Limited, London.

Bowie, N., 1982. Depreciation: Who Hoodwinked Whom?, Estates Gazette, Vol.262, pp.405-411

Canada Mortgage and Housing Corporation, 1998. Replacement Reserve Guide, CMHC, Ottawa.

Cowan, Peter, 1965. Depreciation, Obsolescence and Aging, Architects' Journal, June 16, 1965, pp.1395-1401.

Cowan, Peter, et al, 1969. The Office, a facet of urban growth, Heinemann Educational Books Ltd., London.

Davidson, James, 2004. When is a Reserve Fund “Adequate”? Condominium Manager, Summer 2004.

Derbes, M.J., 1987. Economic Life Concepts, The Appraisal Journal, LV(2): pp.216-224.

Ellingham, Ian, 1995. Building, Aging, Design and the Use of Resources, Ontario Eco-Architecture 2, Conference Proceedings, Toronto.

Ellingham, Ian and Fawcett, William 2006. New Generation Whole-Life Costing, Taylor & Francis, London.

Eschleman, Irene, T., 1993. Financing Condominium Renovations, Journal of Property Management, 58(3), pp.26-29.

Fennell, John, 1995. Renovation Conundrum, Building, Feb/March, 45(1), pp.3-6.

Flanagan, R.; Norman, G.; Meadows, J. and Robinson, G., 1989. Life Cycle Costing. BSP Professional Books, Oxford.

France, J.C., 1959. Age and Ownership of Britain's Housing Stock, Estates Gazette, 7 February 1959, p.224.

HAPM Publications Limited, 1992. HAPM Component Life Manual , Taylor and Francis, London.

Harvey, Nigel, 2006. BMI Life Expectancy of Building Components: A Practical Guide to Surveyors’ Experiences of Buildings in Use (2nd edition), Building Cost Information Service, Royal Institute of Chartered Surveyors, London.

Holister, Danton, undated. Land, Environment, and Structural Change , Unpublished notes on urban conservation, Clare College, Cambridge.

Iselin, Donald G., and Lemer, Andrew C., 1993. The Fourth Dimension in Building: Strategies for Minimizing Obsolescence , (Committee on Facility Design to Minimize Premature Obsolescence, Building Research Board, Commission on Engineering and Technical Systems, National Research Council), National Academy Press, Washington D.C.

Johnstone, I.M., 1998. The Optimum Timing and Maximum Impact of Full Rehabilitation of New Zealand Housing Stock, Environment and Planning A , Vol.30, pp.1295-1311.

Kachelmeier, S.J., and Granof, M.J., 1993. Depreciation and Capital Investment Decisions: Experimental Evidence in a Government Setting, Journal of Accounting and Public Policy, 12(4), pp.291-323.

Kantrow, Alan M., (ed), 1985. Sunrise... Sunset: Challenging the Myth of Industrial Obsolescence, Harvard Business Review Executive Book Series, John Wiley & Sons, New York.

Lichfield, Nathaniel, 1988. Economics in Urban Conservation, Cambridge University Press, Cambridge.

MacLeary A.R., and Nanthakumaran, N., 1988. Property Investment Theory, E.&F.N. Spon, London.

Malpezzi, S., Ozanne, L., and Thibodeau, T.G., 1987. Microeconomic Estimates of Housing Depreciation, Land Economics, 63(4), pp.372-385.

Meij, J. L., 1961. Depreciation and Replacement Policy , North-Holland Publishing, Amsterdam.

Nicholson, Lawrence R., and Zale, Thomas D., 1994. Replacement reserves: A model approach, The Appraisal Journal, 62(2), pp.240-250.

Nicoletti, M., 1968. Obsolescence, Architectural Review , Vol.143, pp.413-415.

Nutt, Bev; Walker, Bruce; Holiday, Susan and Sears, Dan, 1976. Obsolescence in Housing: Theory and Applications, Saxon House Studies, Westmead, England.

Oschrin, Jay, 2005. The life-cycle audit: A way to understand and communicate then need for facility reinvestment, Journal of Facilities Management , March 2005, 3(3). pp.284-292.

Outhred, David R., 1995. Reserves for Replacement in Apartment Properties, A ppraisal Journal, Jan 1, 1995, pp.69-80.

Richardson, Vicky, 1997. Wasting Condition, R IBA Journal, Dec 1997, p.68.

Salway, F., 1986. Depreciation of Commercial Property , College of Estate Management, Reading.

Sayce, Sarah; Smith, Judy; Cooper, Richard and Venmore-Rowland, Peirs, 2006. Real estate appraisal: from value to worth , Blackwell, Oxford.

Schussheim, M.J., 1984. The Impact of Demographic Change on Housing and Community Development, The Appraisal Journal , LII(3): pp.275-281.

Smith, T., 1992. Accounting for Growth, Century Business, London.

Stone, P.A., 1983. Building Economy (Third Edition) Pergamon International, Oxford.

HM Treasury, 2003. The Green Book: Appraisal and Evaluation in Central Government, The Stationary Office, London.

Switzer, J.F.Q., 1963. The Life of Buildings in an Expanding Economy, Chartered Surveyor, Aug. 1963, pp.70-77.

Tanzer, Michelle, 2008. Association Reserve Accounts: Pay Now or Pay Later?, Legal Update, June 2008.

Whittington, G., 1983. Inflation Accounting, Cambridge University Press, Cambridge.

Ward, Keith, 1999. Adequacy of Social Housing Replacement Reserves , Regional Municipality of Peel, Brampton, Ontario.